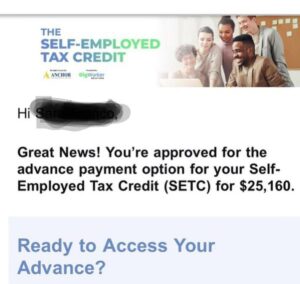

Self-Employment Tax Credit (SETC)

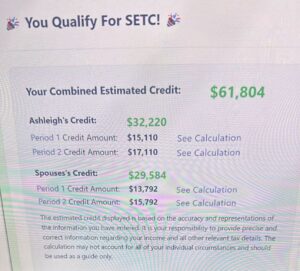

Claim Up to $32,220 in Tax Credits!

Benefits of the SETC

Increase your tax refund or lower current tax debts

Receive up to $32,220 in unrestricted funds

Create a financial safety net for your business

Access expert guidance from former IRS Auditors

What is the Self-Employment Tax Credit (SETC)?

The SETC, established by Congress in the CARES Act of 2020, is a tax credit designed to support self-employed individuals facing financial hardship due to COVID-19. You may be entitled to receive up to $32,220 if you experienced any of the following during 2020 or 2021:

– Illness or COVID-19 symptoms

– Quarantine or testing

– Forced work absence due to child’s school or daycare closures

– Caregiving responsibilities for a child or loved one

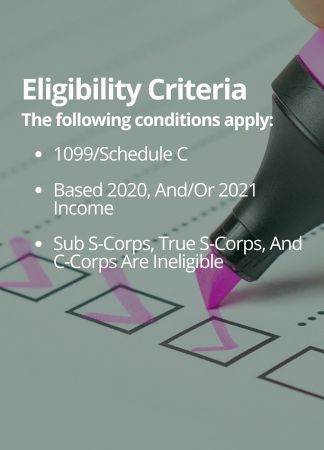

Minimum Requirements

Why Choose SETC Claim Academy?

We’re here to help self-employed individuals like you access the financial support you deserve. Our team of experienced former IRS Auditors is ready to put nearly two decades of knowledge to work for you.

1. Expertise: We’ve helped return over $250 million in SETC refunds to self-employed professionals.

3. Upfront Fee: Small fee to our tax preparation team

4. Simplicity: Qualify within minutes through our easy-to-use process.

THE IMPORTANCE OF USING OR TAX PREPARER SERVICE

IS THIS FOR REAL? HOW DO I KNOW IT'S NOT A SCAM?

Check it out for yourself! The government sets aside money for many things. This is just one of many programs where money is available for you to request.

The government does not advertise it because it’s not what they do, nor do they want you to claim it because once this program ends and if your money isn’t claimed, it will be reallocated back to Congress and used for something else.

Yes, that’s NOT a good thing!

This is only available for a limited time, and qualifying does NOT cost any money upfront. There are all sorts of programs the government puts forth for small businesses. This is your money to qualify for through this site.

Testimonials

Frecuently Asked Questions

The Families First Coronavirus Response Act (FFCRA) was signed into law on March 18, 2020, in response to the economic impact of the pandemic. It mandated employers to provide paid sick leave to employees affected by the pandemic and provided tax credits for doing so. It also allows self-employed individuals to claim these tax credits, which many people have not yet done.

Check it out for yourself! The government sets aside money for many things. This is just one of many programs where money is available for you to request.

The government does not advertise it because it’s not what they do, nor do they want you to claim it because once this program ends and if your money isn’t claimed, it will be reallocated back to Congress and used for something else.

Yes, that’s NOT a good thing!

This is only available for a limited time, and qualifying does NOT cost any money upfront. There are all sorts of programs the government puts forth for small businesses. This is your money to qualify for through this site.

You can qualify for the SETC if:

- You were self-employed during 2020 and/or 2021

- The COVID-19 pandemic affected your work

You need to provide your unaltered tax returns for 2020 or 2021, where you filed as self-employed

You are considered self-employed if you’re a sole proprietor, 1099 subcontractor, single-member LLC, freelancer, independent contractor, gig worker, etc.

No, the SETC does not apply to people that solely have W2 employment nor to any employment that issued you a W2

The SETC is not a loan or a grant; it’s a tax credit. You don’t pay it back, and you don’t pay taxes on it. on their federal tax returns for 2020 and/or 2021

No. C-Corporations (C-Corps) and S-Corporations (S-Corps) are not eligible for the SETC. This tax credit is specifically designed for self-employed individuals who filed a Schedule C or a Partnership (Form 1065) on their federal tax returns for 2020 and/or 2021

The average funding is around $17,000 out of the maximum $32,220. This amount depends on your income level and how many days the pandemic impacted your work. People with dependents also are eligible to claim more SETC on average.

There’s 2 ways to maximize the amount of your refund.

1. Claim more sick days inside the application. (Move the modules around)

2. Get your taxes amended so they can raise your AGI to $70K and this will get your the maximum refund.

Refer to one of the recommended CPAs from us

No, Schedule 1 and Schedule C are not the same.

- Schedule 1 reports additional income (like unemployment, prize money) and adjustments to income (like student loan interest).

- Schedule C reports income and expenses from a sole proprietorship.

They will need to reach our team member and file an amended return before moving forward

After their file has been amended you can proceed with starting app.

You can definitely amend your tax returns, even if you didn’t get a 1099. I’d recommend talking to one of the cpas

No, you do not need to have a business EIN to qualify for the SETC. Self-employed individuals, including sole proprietors, 1099 contractors, freelancers, and single-member LLCs, who reported income on a Schedule C or as a partnership, are eligible. You can use your Social Security Number (SSN) for the application.

We’ll look into this carefully and update you shortly. Rest assured, we’re here to provide the best support possible

You are still eligible if you filed as self-employed for either 2020 or 2021.

No, the SETC is a tax-free credit.

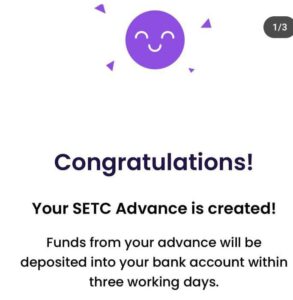

Refunds can be received in as little as 15-20 days after submitting the necessary paperwork.

Yes, receiving PPP or ERC does not disqualify you from the SETC.

You need to submit your tax returns for 2020 or 2021 and a copy of your driver’s license.

The deadline to apply for the SETC is April 18, 2025.

Contact Us

Time is Running Out!

The deadline to file for the 2020 SETC is approaching fast, and the 2021 SETC expires on April 15, 2025. Don’t miss this opportunity to claim the valuable tax credit you’re entitled to!

Remember, this isn't just any fund - it's YOUR money, already allocated by the government, waiting for you to claim. Don't let your hard-earned tax dollars go back into the government's coffers. Let us help you claim what you've earned!